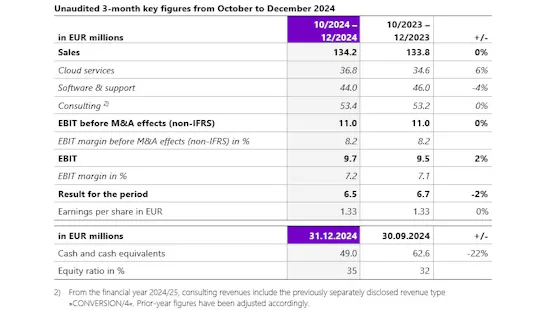

3-Month Results 2024/25

- Sales increase slightly to EUR 134.2 million and exceed prior-year quarter (Oct – Dec 2023: EUR 133.8 million)

- Further dynamic growth in high-margin cloud commissions offsets declining resell licences; cloud services up 6%.

- Share of recurring revenues at 50% (Oct – Dec 2023: 49%) 1)

- EBIT before M&A effects (non-IFRS) stable at EUR 11.0 million (Oct – Dec 2023: EUR 11.0 million)

- EBIT margin before M&A effects (non-IFRS) at a strong 8.2% (Oct – Dec 2023: 8.2%); adjusted for one-time impact of severance payments in Q1, the margin was 8.9%

- Successful growth trajectory with upper mid-market customers: numerous new customers and a strong pipeline for SAP conversions

- Forecast 2024/25 confirmed

Filderstadt, 4 February 2025 – All for One Group SE, a leading international IT service provider focusing on SAP solutions and services, published its results for the period from 1 October to 31 December 2024 today. In the 1st quarter of the current financial year, the company generated sales of EUR 134.2 million, slightly exceeding the EUR 133.8 million from the prior-year quarter. While the successful first quarter of the previous year was strongly influenced by licence sales, revenues are currently being driven by the high demand for migration projects with »RISE with SAP« and »GROW with SAP«. This is primarily due to the large-scale migration of SAP S/4HANA to the cloud announced for 2027.

The strong demand for high-margin migration projects also had an impact on earnings. EBIT before M&A effects (non-IFRS) amounted to EUR 11.0 million in the reporting period (Oct – Dec 2023: EUR 11.0 million). This includes the one-time impact of severance payments of EUR 1.0 million as a result of the new corporate organisation implemented in October. Despite the one-time charges, an EBIT margin before M&A effects (non-IFRS) of 8.2% was achieved, the same as in the prior-year quarter. Adjusted for the one-time impact of severance payments, the margin was 8.9%. The share of recurring revenues stands at 50%, compared to 49% in the same period last year (1) Prior-year figure adjusted due to reallocations of revenue types).

»The growth of the last quarter of 2023/24 is continuing seamlessly into the beginning of the current financial year. All for One is benefiting from strong demand from the upper mid-market for migrations to SAP cloud solutions. This applies both to our own customers, who have not previously used cloud solutions, and to new customers who are moving to SAP to increase their competitiveness and are now relying on All for One's expertise. For us, this is a confirmation of our strategy and a significant expansion of our customer base, which will benefit our future consulting and service business«, explains Michael Zitz, CEO of All for One Group SE. »As the number 1 SAP consultancy, we continue to gain market share and extend our market lead.«

High demand for cloud migration solutions

The unbroken demand for consulting and services relating to SAP conversions is evident in the development of the CORE segment: the demand for migrations to SAP S/4HANA with RISE and GROW from the upper midmarket continues to rise and is leading to a steady increase in capacity utilisation. All for One is benefiting from its strength in cloud transformation, its extensive track record of successful projects and its position as the leading SAP cloud partner in Central Europe. The increase in recurring cloud revenues and commissions offsets the decline in licence revenues and maintenance solutions from expiring on-premise contracts. With sales of EUR 120,7 million (Oct – Dec 2023: EUR 119.5 million) and EBIT before M&A effects (non-IFRS) of EUR 10.2 million (Oct – Dec 2023: EUR 9.5 million), the segment is ahead of plan and accounts for 89% of total Group sales. The EBIT margin is therefore 8.5% (Oct – Dec 2023: 8.0%). Adjusted for the one-time impact of severance payments, the margin was 9.2%.

In the lines of business solutions (LOB segment), which accounts for 11% of sales, there is currently, as expected, a lack of positive impetus from the economy. As many customers are at present focusing on investments related to the necessary ERP migration and core software functions, expansion investments are being postponed. Nevertheless, All for One continues to view the LOB segment as a key component of its core business (land and expand strategy) and expects an upturn as the economy improves. However, as a sustained recovery in demand in this area is not yet in sight, the Company has taken proactive measures to increase efficiency in order to ensure the profitability of the LOB segment in the coming quarters. Segment revenues for the period were EUR 18.4 million (Oct – Dec 2023: EUR 18.5 million) and EBIT before M&A effects (non-IFRS) decreased to EUR 0.7million (Oct – Dec 2023: EUR 1.5 million) with a margin of 4.0% (Oct – Dec 2023: 8.1%).

»The different developments in the segments are symptomatic of the challenges in our market. The need to digitalise business models to remain competitive and the strong demand for cloud ERP systems are being countered by the weakening economy and declining investment. However, with All for One Group's strong position in the transformation business, our international presence and our award-winning expertise, we are able to compete and even grow our customer base beyond the actual market growth«, adds Stefan Land, CFO of All for One Group.

The equity ratio as of 31 December 2024 increased to 35% (30 Sep 2024: 32%). The number of employees as of 31 December 2024 was 2,777 (31 Dec 2023: 2,807).

Continuation of growth path: 2024/25 forecast confirmed

The management board of All for One Group expects the continuation of the growth trajectory during the 2024/25 financial year. On the other hand, the increasing need for digitalisation and the urgency of migrating to cloud-based ERP systems will counterbalance the generally subdued economic development. However, it can be expected that there will be further timing fluctuations and delays in some contract signings and project starts. In particular, in the LOB segment, it is expected that investments in software expansions, which are not immediately necessary, will be at least partially postponed.

With its positioning as a consulting and service provider across the entire ERP lifecycle, All for One Group sees itself as excellently positioned to benefit from various cycles. Therefore, the management board expects the positive performance in the CORE segment to compensate for the temporarily weaker performance in the LOB segment. Based on current knowledge and against the backdrop of a continued robust and strong order situation, the extensive project pipeline and a growing customer base, the management board continues to expect revenue growth between EUR 525 million and EUR 540 million in 2024/25 (2023/24: EUR 511.4 million). EBIT before M&A effects (non-IFRS) is expected to be between EUR 36.5 million and EUR 40.5 million (2023/24: EUR 34.0 million). The business performance to date and the strong order pipeline confirm this estimate.

All for One Group also anticipates robust, organic sales growth in the mid-single-digit percentage range in the coming years, complemented by inorganic growth in promising portfolio areas and markets. The EBIT margin before M&A effects (non-IFRS) is expected to exceed 8% in the financial year 2025/26.

All for One Group SE will be publishing the full quarterly statement for the 3-month period 2024/25 on 10 February 2025.

With the report for the 1st quarter of All for One Group SE, the previously separate reporting of »CONVERSION/4« revenues is no longer included. This category exclusively covered transformation projects where the technical transformation, using the Bluefield approach, was semi-automated with the Crystalbridge technology from the SNP partner. Meanwhile, both SAP and other providers now offer various tools (software) for the migration (conversion) from SAP ECC to SAP S/4HANA, which All for One Group also offers to its existing and new customers. In addition, there are customers who implement SAP S/4HANA using the Greenfield approach, i.e., with entirely new or revised processes. It no longer makes sense to separate the two approaches, which is why »CONVERSION/4« has been integrated into the consulting revenue type.